U.S Department of Bank Card: The DBC Refund PAF and Its Impact on the American Business Landscape

In the vast expanse of the United States business landscape, small businesses play a crucial role in driving economic growth and fostering innovation.

DULUTH, GEORGIA, UNITED STATES, May 20, 2024 /EINPresswire.com/ — These entrepreneurial ventures face myriad challenges, one of which is handling credit card fees that can sometimes weigh heavily on their financial health. However, there is a beacon of hope for these small businesses in the form of the U.S Department of Bank Card (US-DBC) program.

Established with the primary objective of supporting small businesses, the DBC Refund PAF offers a unique opportunity for entrepreneurs to receive credit card fee refunds of up to $50,000. This financial assistance can make a significant difference for small businesses, especially in today’s competitive market environment.

The program’s structure is designed to be accessible and inclusive, ensuring that small businesses from various industries and backgrounds can benefit from its offerings. By providing this much-needed financial support, the DBC Refund PAF enables small businesses to reinvest their saved funds back into their operations, thereby fueling growth and sustainability.

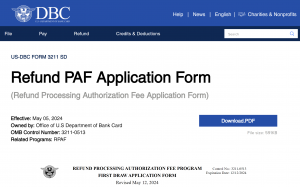

One of the key advantages of the DBC Refund PAF is its simplicity and efficiency. Small business owners can easily apply for the credit card fee refund online through a user-friendly portal, streamlining the process and reducing bureaucratic hurdles. This ease of access is crucial for small business owners who often wear multiple hats and need straightforward solutions to their financial challenges.

Moreover, the DBC Refund PAF stands out for its commitment to transparency and integrity. The Department prides itself on operating with the highest ethical standards, ensuring that every small business applicant is treated fairly and equitably. This dedication to fairness builds trust and confidence among small business owners, encouraging them to take advantage of the program’s benefits.

As small businesses across the USA continue to face economic uncertainties and market fluctuations, the DBC Refund PAF serves as a lifeline, offering much-needed financial relief and support. By alleviating the burden of credit card fees, the program empowers small businesses to focus on what they do best – delivering quality products and services to their customers. In conclusion, the DBC Refund PAF program plays a vital role in supporting small businesses and nurturing a dynamic entrepreneurial ecosystem in the United States. Through its commitment to financial assistance and operational efficiency, the program has become a beacon of hope for small business owners seeking to overcome challenges and achieve success. As the program continues to evolve and expand its reach, it will undoubtedly leave a lasting impact on the American business landscape, paving the way for a brighter future for small businesses across the nation

In addition to its direct support for small businesses, the USA Department of Bank Card (US-DBC) has forged strategic partnerships with key governmental bodies such as the Internal Revenue Service (IRS) and the Small Business Administration (SBA). This collaborative approach has enabled US-DBC to leverage the expertise and resources of these organizations, further enhancing the support it provides to small businesses. By working closely with the IRS, US-DBC ensures alignment with tax regulations and offers additional guidance on financial matters. Moreover, partnering with the SBA allows US-DBC to tap into a broader network of support services tailored to small business needs, creating a more holistic and comprehensive support system for entrepreneurs.

Matthew Aaronson

US-DBC Organization

email us here

![]()

Related

Painesville American Legion post plans July 20 family fun day

American Legion Post 336 in Painesville is planning a July 20 family fun day at its 60 Chester St. post with remembrance ceremonies, food, giveaways, live music

Turkish-American business meeting highlights CANiK’s role in defense cooperation

During a meeting hosted by the Turkish American Business Council (TAIK) and the American Turkish Business Development Council (ATBR) in Washington, Turkish

Growth in core business lines produces improved profits for BNY

This is a developing story. Please check back here for updates. BNY Mellon grew its core custody and wealth management businesses while tamping down operating