US Shuts Down China’s Access to Advanced American Tech

The Biden administration has recently set some pretty major limits on American investments in advanced technologies in China, a move aimed at safeguarding our national security and tech innovation.

Starting January 2, 2024, a new Treasury Department rule will restrict American investment in three tech areas—semiconductors, quantum information, and artificial intelligence (AI)—specifically targeting advancements that could aid China’s military and intelligence capabilities.

This policy follows an executive order President Joe Biden issued back in August 2023, and it’s sparking a lot of discussion about the future of American investments in global tech. Here’s a more in-depth look at the recent ruling.

Why Block Investments in Chinese Tech?

At the heart of these measures is America’s concern over certain “countries of concern,” a list that currently zeroes in on China (along with Hong Kong and Macao).

The Treasury Department, in an October 28 release, considers these emerging technologies essential to future military and cybersecurity applications.

In simple terms, Washington wants to avoid a scenario where US-developed technology is powering adversarial capabilities in surveillance, military operations, or cyber warfare.

Paul Rosen, assistant secretary for investment security, put it plainly: the US doesn’t want American investments helping China develop advanced military or intelligence tools. With advancements like quantum computing and AI progressing rapidly, the stakes are high.

“US investments, including the intangible benefits like managerial assistance and access to investment and talent networks that often accompany such capital flows, must not be used to help countries of concern develop their military, intelligence, and cyber capabilities,” Rosen explained.

The Biden administration has recently set some pretty major limits on American investments in advanced technologies in China, a move aimed at safeguarding our national security and tech innovation.

Starting January 2, 2024, a new Treasury Department rule will restrict American investment in three tech areas—semiconductors, quantum information, and artificial intelligence (AI)—specifically targeting advancements that could aid China’s military and intelligence capabilities.

This policy follows an executive order President Joe Biden issued back in August 2023, and it’s sparking a lot of discussion about the future of American investments in global tech. Here’s a more in-depth look at the recent ruling.

Why Block Investments in Chinese Tech?

At the heart of these measures is America’s concern over certain “countries of concern,” a list that currently zeroes in on China (along with Hong Kong and Macao).

The Treasury Department, in an October 28 release, considers these emerging technologies essential to future military and cybersecurity applications.

In simple terms, Washington wants to avoid a scenario where US-developed technology is powering adversarial capabilities in surveillance, military operations, or cyber warfare.

Paul Rosen, assistant secretary for investment security, put it plainly: the US doesn’t want American investments helping China develop advanced military or intelligence tools. With advancements like quantum computing and AI progressing rapidly, the stakes are high.

“US investments, including the intangible benefits like managerial assistance and access to investment and talent networks that often accompany such capital flows, must not be used to help countries of concern develop their military, intelligence, and cyber capabilities,” Rosen explained.

These are the kinds of technologies that could make a huge difference in code-breaking, combat systems, and complex decision-making tools—areas where global competition is fierce.

What Technologies Are Targeted?

The new rule casts a wide net across three major tech areas that experts agree will shape the future:

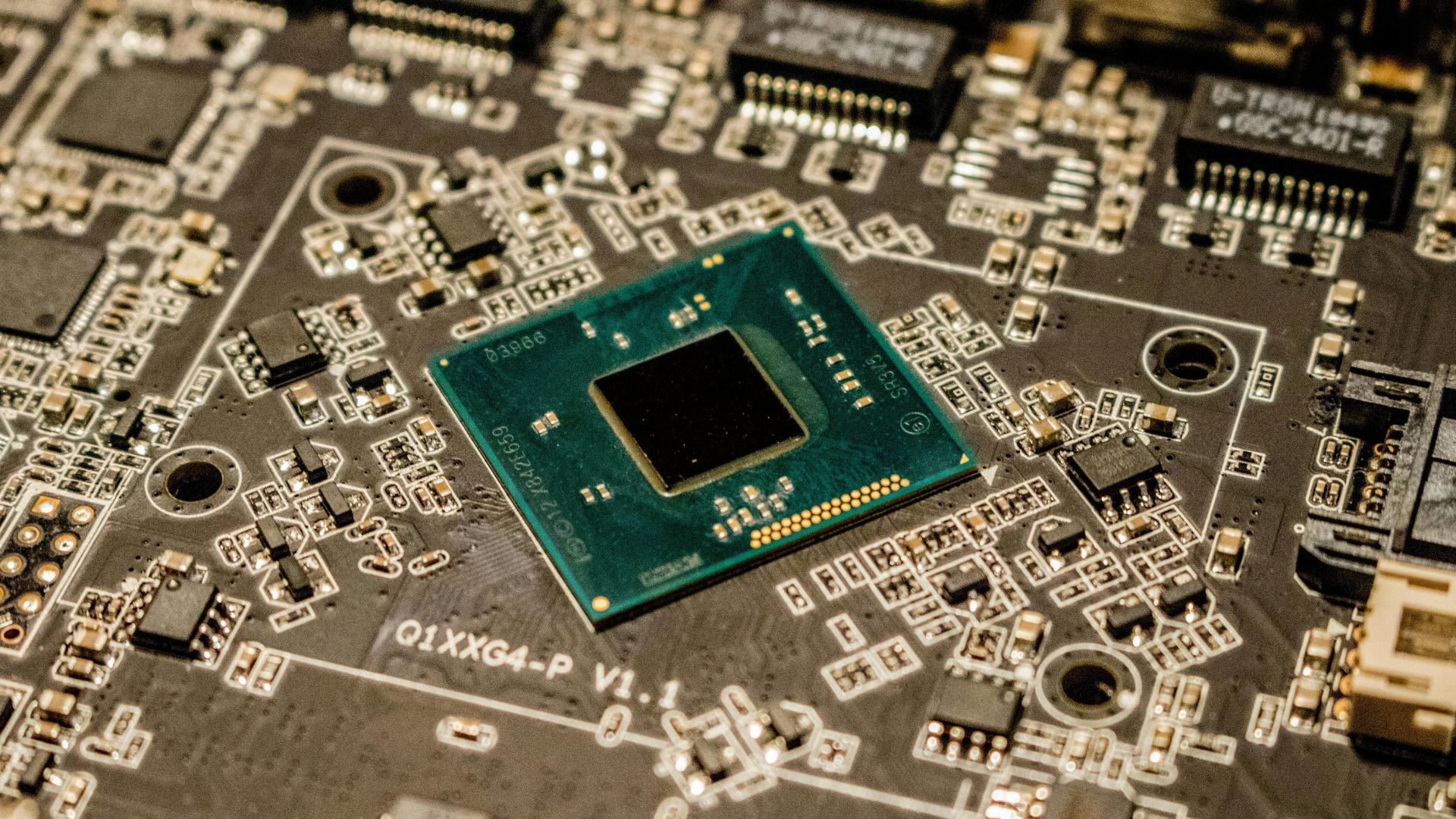

1 | Semiconductors and Microelectronics

Both semiconductors and microelectronics components are the building blocks of modern tech, crucial for everything from smartphones to sophisticated defense systems. As the global semiconductor shortage showed, controlling access to these chips is key to maintaining economic and security stability.

2 | Quantum Information

Quantum technology is often called the next frontier, especially for cybersecurity. Quantum computers, unlike traditional ones, can solve problems and decrypt information at mind-bending speeds, posing both opportunities and threats. As this field progresses, having an edge in quantum information could be transformative for military strategy and cyber defense.

3 | Artificial Intelligence (AI)

AI’s potential for boosting productivity, accuracy, and predictive analytics is enormous, but so is its risk when used for surveillance or military applications. AI-powered technologies could strengthen enemy defenses, improve espionage, and even support unmanned combat systems, so the US sees value in restricting how much American influence goes into Chinese AI development.

The rule only applies to cutting-edge uses of these technologies that might directly or indirectly enhance military or intelligence capabilities.

More basic tech investments aren’t affected, so American companies can still engage with Chinese tech—just not in the ways that could turn into security liabilities.

How Does This Affect American Businesses?

For tech companies and venture capitalists in the US, this rule may close off some potential markets.

Phil Siegel, founder of the AI nonprofit CAPTRS, stated that while this rule could limit US companies’ access to China’s massive market, it’s likely to have limited short-term impact, Fox News noted in a report.

The focus is on preventing high-stakes technology from reaching potential adversaries, rather than cutting off all US-China tech relations.

Siegel pointed out an interesting flip side to this approach, though.

Restricting American investments could reduce the US’s ability to monitor China’s progress in these tech fields. Keeping an eye on China’s tech development has its advantages—when it’s easier to track their progress, the US gains insight into any emerging threats.

However, this visibility can be sacrificed in the interest of slowing China’s access to American innovation.

China’s Reaction: Not Happy

It’s no surprise that China isn’t thrilled with these new restrictions.

China’s Foreign Ministry condemned the US decision, stating that it “firmly opposes” the US blocking investments that target their tech sector.

China even lodged an official protest, underscoring how seriously it takes the impact on its tech ambitions.

#FMsays Beijing is strongly opposed to Washington’s latest restrictions on its high-tech exports to China, and has lodged stern representations with the US side, FM spokesman Lin Jian said, vowing to safeguard China’s legitimate rights and interests with all necessary measures. pic.twitter.com/xwyf4sLXlK

— China Daily (@ChinaDaily) October 29, 2024

For China, the American investment market is not only valuable for funding but also a channel for collaboration and idea exchange. Limiting this access doesn’t sit well with Beijing, which has been ramping up its own tech ambitions.

“China deplores and rejects the US’s Final Rule to curb investment in China […] and will take all measures necessary to firmly defend its lawful rights and interests,” said Lin Jian, Chinese Foreign Ministry spokesperson, during a regular press briefing last Tuesday, October 29.

A New Era of “Tech Guardrails”

This policy is part of a broader approach by the US to secure its technology edge and national security by creating “tech guardrails” around China. It follows export restrictions, cybersecurity standards, and data-sharing limitations that Washington has placed on its dealings with China over the past few years.

The goal is to slow down China’s access to advanced technologies, especially those with a military edge, and give America an advantage in shaping the future of global security.

Whether this approach will yield the intended long-term benefits remains to be seen, but the US has made it clear it’s willing to forgo some short-term business opportunities for what it sees as a bigger security payoff.

As this rule takes effect, American investors and tech companies will be adapting to a world where business with China has tighter boundaries, especially in technology.

Related

Wealthy West Coast suburb is living in fear as South…

Residents of a wealthy West Coast suburb are terrified that a South American gang is surveilling them closely using drones to target their homes. Three homes i

American Airlines employs new tech in Austin to catch early…

In what feels like an episode of Curb Your Enthusiasm, American Airlines is expanding a new system to catch passengers who try to sneak ahead in line. Accor

US Jobs: Top 10 companies sponsoring H-1B visas in 2024…

The analysis of H-1B visa sponsorship data for 2024 reveals a notable decline in sponsorships, particularly by major US tech companies. Firms like Amazon, Inf

American Airlines is deploying new tech to shame boarding line…

American Airlines has a new tactic for shaming boarding line cutters: A loud beeper. CNBC reports that the airline is rolling out a system that emits two loud