How American Express Travel Insurance can help protect your winter travels – The Points Guy

Travel doesn’t always go as expected. For example, if your airline loses your checked luggage, you end up in the hospital during your trip, or a close family member becomes unexpectedly ill, dealing with these situations can be costly. That’s where travel insurance may help.

You might already know that some travel rewards cards have embedded travel insurance benefits when you use your card for purchases. We won’t discuss that type of travel insurance in this article; instead, we’ll discuss a specific type of travel insurance you can purchase on a trip-by-trip basis.

American Express® Travel Insurance offers preset packages and the ability to select just the coverage options you want. You don’t need to use an Amex card or even be an American Express cardmember to purchase American Express Travel Insurance.

What is American Express Travel Insurance?

American Express Travel Insurance may help provide coverage for the unexpected.

You can select a preset package, which will come with set benefits and coverage amounts — these options allow you to get a package without needing to think through all the details yourself.

You also have the ability to purchase exactly what you want for your trip. For example, if you only want to purchase Global Medical Protection, you can do that. This ability to purchase only the coverage you want is relatively unique among the types of travel insurance I’ve researched.

You can purchase American Express Travel Insurance with any debit or credit card, including those not issued by American Express. You don’t need to be an American Express cardmember to purchase American Express Travel Insurance as you can use any debit or credit card to purchase.

Unlike other travel insurance policies that may not cover all your travel companions, American Express Travel Insurance allows you to enroll up to 10 people (including yourself), and also gives you the ability to cover travel companions outside of your family.

Due to the ability to pick only the protections you want or a preset package at a price point that fits your needs, American Express Travel Insurance offers particularly good options for travelers who are budget conscious or need the ability to customize coverage.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

In the next sections, we’ll discuss the types of preset packages and a la carte coverage you can purchase with American Express Travel Insurance. Then, we’ll discuss how to buy this insurance.

Related: Should you get travel insurance if you have credit card protection?

What types of American Express Travel Insurance are available?

American Express Travel Insurance offers preset packages, but you can also build your own coverage and select only the protections you want. The best way to see the options for a specific trip is to click the link in the previous sentence and enter a few details about your trip, but here’s a look at both types of products.

Build your own coverage

Being able to select only the protections you want is relatively unique, so here’s a look at the types of coverage that American Express Travel Insurance offers that I could select as a Florida resident for a sample trip:

- Trip Cancellation & Interruption: This type of coverage may provide reimbursement for nonrefundable expenses or additional costs if you need to cancel your trip before it starts. This coverage may also provide reimbursement for additional costs if your trip is interrupted. However, this coverage isn’t available for the portion of your trip purchased with travel award credits, points or miles.

- Global Medical Protection: This type of coverage may cover emergency medical and dental expenses on a trip that originates from the covered person’s permanent residence, is outside a 150-mile radius from the covered person’s permanent residence and occurs within the first consecutive 60 days of the trip. This coverage also includes an emergency evacuation benefit that will arrange and pay for evacuation to the nearest adequate medical facility if you suffer from a sickness or sustain an accidental injury and require treatment while on a covered trip. You can select from three coverage limits when purchasing this coverage, although the dental coverage maximum is $750 with all three options.

- Travel Accident Protection: This type of coverage is payable if the covered person suffers an accidental death or dismemberment while boarding, traveling in, or deplaning from a scheduled airline or common carrier conveyance. When purchasing this coverage, you can select from two coverage limits.

- Global Baggage Protection: This type of coverage may reimburse for lost, damaged or stolen baggage, whether checked or carried on your flight or on your hotel or cruise property. This coverage may also provide reimbursement for essential replacement items if your baggage is delayed. When purchasing this coverage, you can select from four coverage limits.

- Global Trip Delay: This type of coverage may reimburse lodging and other necessary expenses if a covered person’s travels are delayed, including if your flight is overbooked and you are involuntarily denied boarding, if you miss your flight connection, and if your flight departure is delayed or canceled. When purchasing this coverage, you can select from three coverage limits.

These a la carte coverage options include access to a 24-hour Travel Assistance Hotline that may offer travel support anytime before and during your trip.

Related: What’s covered by credit card travel accident and emergency evacuation insurance?

Preset packages

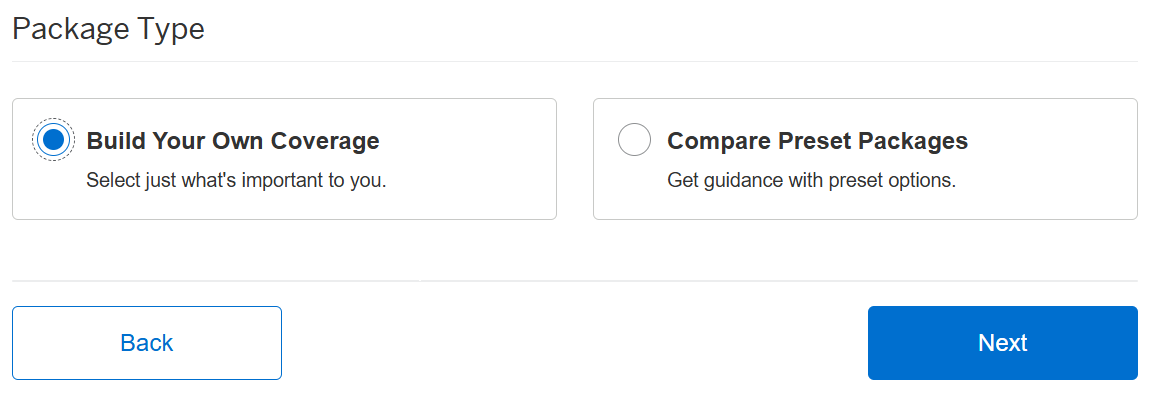

American Express Travel Insurance also offers four preset packages, each including an assortment of types of coverage. These packages provide an easy way to buy coverage for an upcoming trip without making many decisions.

The basic package includes Trip Cancellation & Interruption, Global Medical Protection and Global Baggage Protection, but does not include Travel Accident Protection or Global Trip Delay.

The Silver, Gold and Platinum packages include all the types of coverage you could buy but at differing levels. The Silver package offers the lowest coverage levels, while the Platinum package offers the highest ones.

Related: What your credit card’s trip protection covers — and what it doesn’t

How to buy American Express Travel Insurance

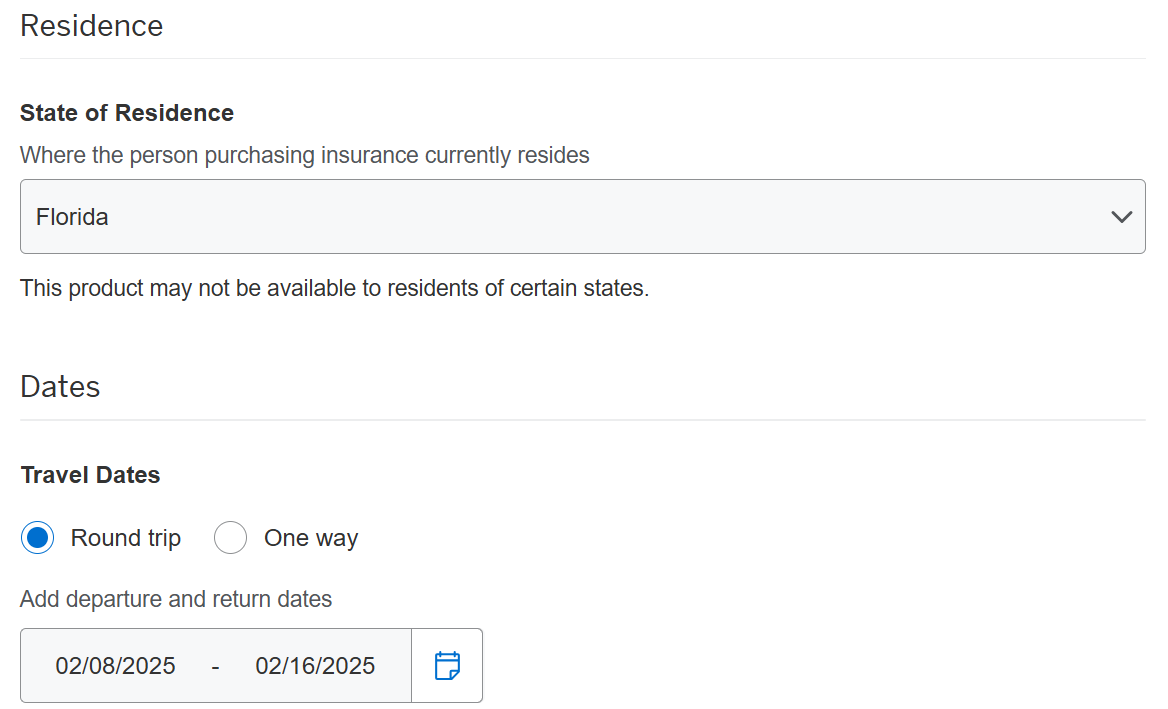

With American Express Travel Insurance, you can see your coverage options within seconds. Click the link in the previous sentence and enter the details of your trip. For example, if I wanted to purchase American Express Travel Insurance for a winter ski trip, I’d start by entering my state of residence and my travel dates.

Then, I’d need to enter the number of travelers and each traveler’s trip cost and age.

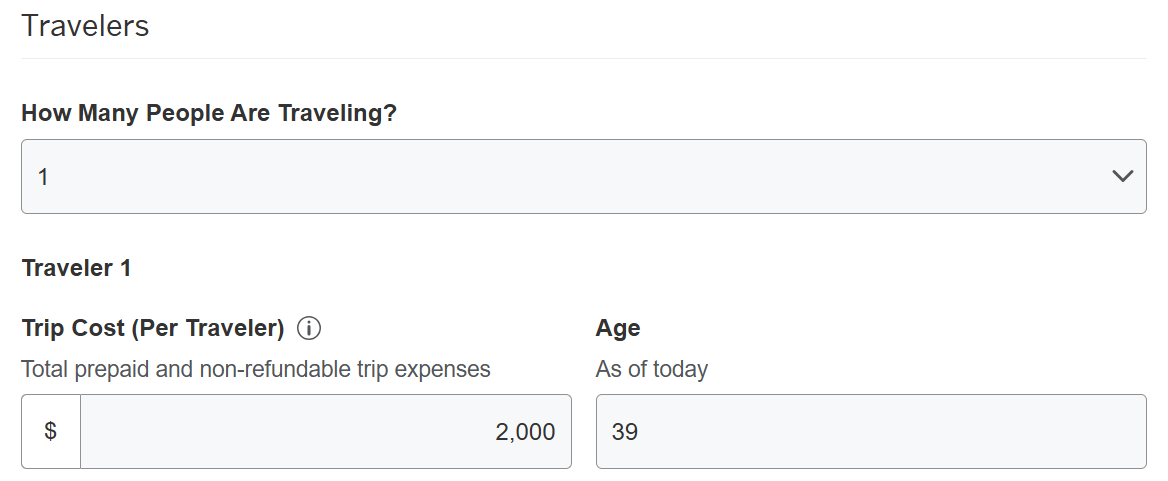

Next, I can choose the Build Your Own Coverage option or the one that lets you compare preset packages. However, this choice isn’t all that important, as you can toggle between the choices on the next page. For now, let’s assume I opted to build my own coverage.

For this trip, here’s a look at the build-your-own-coverage options and pricing:

- Global Trip Delay: No coverage, $14 for up to $150 of coverage per day ($500 maximum per trip), $15 for up to $200 of coverage per day ($750 maximum per trip) or $20 for up to $300 of coverage per day ($1,000 maximum per trip)

- Global Baggage Protection: No coverage, $20 for up to $500 of coverage (up to $300 of coverage for a six-hour or longer delay), $35 for up to $1,000 of coverage (up to $500 of coverage for a six-hour or longer delay), $40 for up to $1,500 of coverage (up to $500 of coverage for a six-hour or longer delay) or $50 for up to $2,500 of coverage (up to $500 of coverage for a three-hour or longer delay)

- Trip Cancellation & Interruption: No coverage or $80 for up to 100% of the trip cost

- Global Medical Protection: No coverage, $25 for up to $25,000 of coverage (dental coverage of up to $750), $30 for up to $50,000 of coverage (dental coverage of up to $750) or $32 for up to $100,000 of coverage (dental coverage of up to $750)

- Travel Accident Protection: No coverage, $11 for up to $250,000 of coverage, $19 for up to $500,000 of coverage, $27 for up to $1,000,000 of coverage or $35 for up to $1,500,000 of coverage

Alternatively, I could select one of the four preset packages. For my sample trip, the Basic package would cost $59, the Silver package would cost $99, the Gold package would cost $122 and the Platinum package would cost $170.

Regardless of whether I opt to build my own coverage or buy a preset package, I’d need to enter my full name, date of birth, destination country and date of first trip payment before reaching the payment screen, where I’d need to enter my name, billing address, phone number, email and credit card information.

Prices and coverage options may vary for your trip. Be sure to examine the certificate of insurance once you purchase coverage to fully understand your policy. You usually have 14 days after you purchase a policy to examine the certificate of insurance and void it if necessary.

Bottom line

American Express Travel Insurance offers build-your-own-coverage options and preset packages. The build-your-own-coverage options are particularly appealing if you value the ability to buy only the coverage you want at a relatively low cost, especially if you only need one or two types of coverage for an upcoming trip.

Travel with more confidence and purchase American Express Travel Insurance for your next trip.

For complete details and the full terms and conditions, please visit the American Express Travel Insurance website here.

American Express Travel Insurance (Policy AX0126, or Policy AETI-IND) is underwritten by AMEX Assurance Company, Administrative Office, Phoenix AZ. Coverage is determined by the terms, conditions and exclusions of the respective policies (see above) and is subject to change with notice. This document does not supplement or replace the Policy.

American Express Travel Insurance is offered through American Express Travel Related Services Company, Inc., California license number 0649234.

Related

U.S. issues major travel advisory to South American country due…

You might want to rethink your travel plans to this South American nation this winter.The U.S. State Department issued a “Level 2: Exercise Increased Caution�

Trump administration cancels travel for refugees already cleared to resettle…

WASHINGTON (AP) — Refugees who had been approved to travel to the United States before a deadline next week suspendi