Trump tariffs will save American jobs and level the playing field I Opinion

President Donald Trump’s tariffs on aluminum imports is about far more than a trade battle. It’s a fight for the survival of an essential American industry.

President Trump planning 25% tariffs on European Union

President Donald Trump said he plans to hit the European Union with 25% tariffs, including on cars.

In 2018, President Donald Trump implemented Section 232 tariffs on aluminum and steel to protect American producers from a flood of unfairly priced imports threatening our national security.

The impact of the Trump tariffs was immediate: Century Aluminum, America’s largest producer, restarted idle production lines; Alcoa expanded operations; U.S. aluminum production surged; and a key industry undergirding our national security was reborn.

Enter President Joe Biden: He handed out a complex web of exemptions for other countries and alternative trade arrangements that severely weakened the effectiveness of the Trump tariffs. Predictably, imports once again surged, and by 2024, U.S. aluminum capacity utilization had plummeted to a dangerous 52%, with smelters shutting down and American jobs disappearing.

Now, President Trump is taking bold action once again. He has raised the aluminum tariff from 10% to 25% while eliminating all country-specific exemptions.

This decisive move sends a clear message: The era of unchecked imports undermining American industry is over. The United States will no longer be a dumping ground for heavily subsidized and unfairly traded aluminum.

Predictably, foreign nations are complaining about the new Trump aluminum tariffs. Yet, history needs to be our guide because every one of the countries that benefitted from exemptions or alternatives to the tariff abused the privileges America granted them.

Imports from US allies have flooded American market

It’s not just strategic competitors like China and Russia that have exploited exemptions and loopholes and flooded the U.S. aluminum market. Nations considered U.S. allies also have been a big part of the problem.

Consider Australia. Its heavily subsidized smelters operate below cost, giving them an unfair dumping advantage, while Australia’s close ties to China further distort global aluminum trade.

Initially, voluntary restraint agreements in lieu of the Trump tariff kept Australian exports in check. However, once Biden took office, exports surged. In 2024, Australian capacity utilization hit 90% even as American capacity utilization plummeted to nearly 50%.

As for Canada, with a massive overcapacity of more than 3.3 million metric tons, Canada has historically exported the bulk of its aluminum to the United States.

The consequences of Canada’s cascade of aluminum have been severe: Alcoa was forced to idle its Intalco smelter in Washington state, and other U.S. smelters have struggled to remain profitable – even as the Canadian arm of Alcoa has prospered.

Meanwhile, Alcoa and Rio Tinto, which dominate both Canadian and Australian aluminum markets, have strategically shifted exports to the United States between the two countries to maximize profits. (China is the largest Rio Tinto shareholder.)

While Australia and Canada represent frontal assaults on our aluminum markets, Mexico does not have a primary aluminum industry of its own. Yet it has become a critical entry, transshipment and tariff evasion point for foreign aluminum producers looking to bypass U.S. trade restrictions.

Mexico is relay point for goods shipped into US

In this circumvention game, China, Russia, India and the United Arab Emirates have all funneled massive amounts of aluminum into Mexico, processing it into products like extrusions before shipping it tariff-free into the United States.

The numbers tell the story − by 2024, imports from Mexico were 35% higher than the average volume for 2015 through 2017.

As a result, U.S. aluminum extruders have struggled to compete, resulting in layoffs and plant closures. Moreover, Chinese firms have aggressively expanded their Mexican operations, investing hundreds of millions of dollars into extrusion plants that serve as a conduit for tariff-free exports to our country.

Then there is Argentina. Like many other nations, Argentina’s primary aluminum producers have relied on heavy government subsidies to maintain operations, distorting prices in the global market.

Operating under yet another alternative arrangement, Argentine exports are now more than 200% higher than the average before Trump’s original tariffs were imposed in 2018. Meanwhile, Aluar Aluminio, Argentina’s dominant producer, has restarted idled capacity, meaning that even more aluminum could soon flood the U.S. market.

Finally, there are the European Union and United Kingdom. Taking full advantage of their ability to ship aluminum here without restriction, the EU’s exports to the United States have climbed above $3 billion per year and are now higher than before the 2018 tariffs were implemented. America is the world’s second largest importer of aluminum from the UK.

It’s the same old “subsidize and dump” story here that we see with both aluminum and steel exports to the United States. For example, European producers, backed by extensive government subsidies, have restarted idled capacity in countries like Germany and France.

President Trump is now writing a new story for the United States. With one stroke of Trump’s pen, the Biden era of idled smelters and declining capacity utilization will come to an end as a golden age of American aluminum production regains its rightful place as a pillar of national security and economic strength.

This is far more than a trade battle. It’s a fight for the survival of an essential American industry.

Peter Navarro is the White House senior counselor for trade and manufacturing.

Related

US employers warned against favouring foreign workers over Americans –…

The US is grappling with an immigration crisis, with the Trump administration implementing measures to deport undocumented individuals and opposing job abuse in

‘Cruel and thoughtless’: Trump fires hundreds at US climate agency…

The Trump administration has fired hundreds of workers at the National Oceanic and Atmospheric Administration (Noaa), the US’s pre-eminent climate research ag

Federal job cuts disrupt a stable retirement picture for many…

A person displays a sign as labor union activists rally in support of federal workers during a protest, with the U.S. Capitol in the background on Capitol Hill

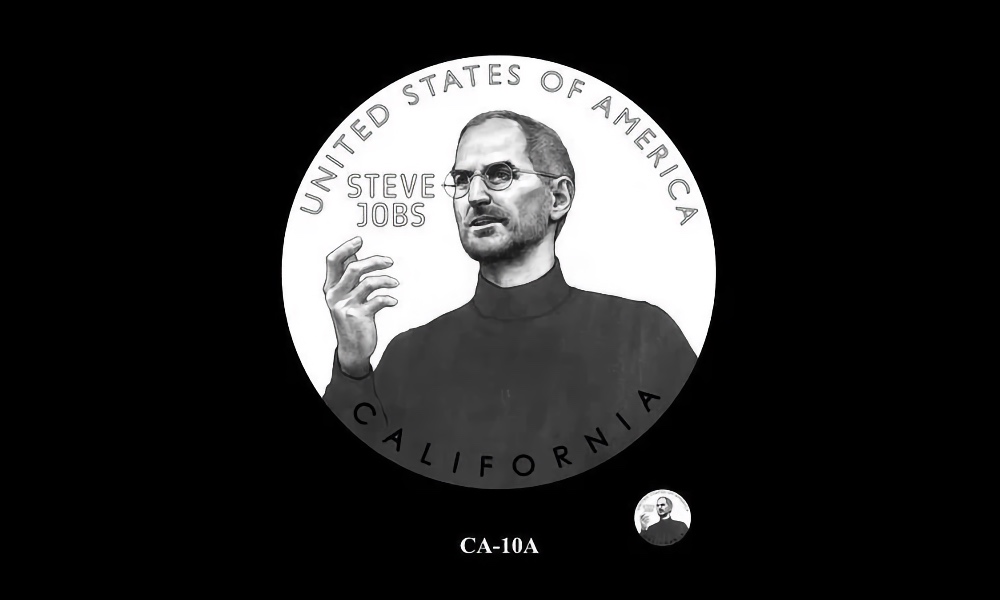

California Governor Newsom Nominates Steve Jobs to Appear on $1…

Governor Gavin Newsom has nominated Apple co-founder and former CEO Steve Jobs to be commemorated on the $1 American Innovation Coin for the State of Califo