American International Stock: Business Simplifying, Shares Appear Fully Valued (NYSE:AIG)

JHVEPhoto

Shares of American International Group (NYSE:AIG) have been a strong performer over the past year, gaining about 31%. However, shares have declined about 8% from recent highs. I last covered AIG in January, when I downgraded shares to a “hold,” and since that recommendation, shares have underperformed, returning 12% vs the S&P 500’s 15% gain. Recently, the company passed a significant milestone in its simplification effort, as it will no longer consolidate Corebridge (CRBG) results starting in Q2, making now a natural time to re-evaluate AIG shares. I view shares as fully valued and would not add.

In the company’s first quarter, it grew adjusted EPS by 9% to $1.77. Now, it is important to note these results included results from CRBG, which it classifies as Life and Retirement units. Going forward, CRBG will not be consolidated. I have argued investors should focus just on AIG’s “general insurance” business, which is its wholly owned property and casualty unit and then add back the value of its CRBG stake based on where those shares are trading, to determine a fair value for AIG.

Before turning to its own results, I would note several developments around its CRBG stake. AIG sold 30 million shares for $876 million in May. Those proceeds are $1.31 per AIG share. It was this transaction that took AIG’s stake below 50%, which is why it can now deconsolidate CRBG. It is important to note that this was always the long-term plan after AIG IPOed Corebridge. AIG has, since the financial crisis, simplified its business, turning into a streamlined pure play P&C insurer. It has been reducing its stake in CRBG gradually in order to maximize the value of its position.

Beyond this open market sale, AIG is also selling a 20% stake in Corebridge to Nippon Life for $3.8 billion. That deal will close in Q1 2025, subject to regulatory approval. As part of this deal, AIG will have to retain a 9.9% stake for two years. The proceeds from this transaction will be $5.67, and with the price agreed upon, there is no mark-to-market risk. With the proceeds from these two sales, AIG could buy back about 9% of the company, given where shares currently trade.

Even after these sales, AIG retains a ~28% stake in Corebridge. Its remaining stake is worth $4.9 billion at current market levels. That is worth $7.30. It will have to hold about one-third of this stake for two years as part of the Nippon Life deal, as a reminder. Still by gradually selling the rest of the stake, AIG will have ample repurchase capacity. Overall, AIG’s position in CRBG is worth $14.28, with about half not subject to market risk and half subject to market risk. I recently covered Corebridge’s standalone prospects and rate shares a “buy” and as such am comfortable with the mark-to-market risk.

With proceeds of these sales and its own capital generation, AIG has been aggressively returning capital to shareholders. It did $1.7 billion of Q1 repurchases and bought back another $613 million in April. AIG has cut its share count by 9% since the end of 2022 and importantly also cut debt by $1.9 billion to $9.8 billion. As a result, its 23.6% debt to capital is down from 26.3% last year. AIG has not only reduced share count but also strengthened its balance sheet.

On top of this, AIG raised its dividend by 11% to $0.40 last quarter. I have been assuming a $1.5 billion quarterly pace of repurchases, but I now see slight upside risk to this. I would expect this pace to continue in 2025, as the Nippon Life proceeds will not be received until early next year and should facilitate ongoing repurchases. AIG also carries a healthy $5.1 billion of holding company liquidity, enabling ongoing capital returns. Knowing it has the Nippon proceeds coming, it is possible AIG buys back a bit more stock in H2 2024, reducing holding company liquidity, then replenishing liquidity with those proceeds.

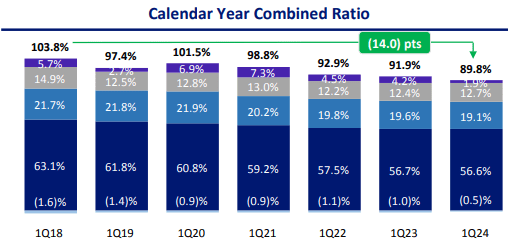

Turning to its core business, we continue to see improving underwriting results, which has been a consistent trend, as you can see below. AIG’s calendar year combined ratio of 89.8% was a 2.1% improvement from last year. Its adjusted accident year combined ratio improved by 1.6% to 88.4%. During the quarter, AIG wrote $4.5 billion of general insurance premiums, essentially flat from last year, adjusting for divestitures. Pre-tax income rose by 9% to $1.36 billion with $596 million in underwriting income.

AIG

Now, much of the easy gains have been achieved, and I continue to expect its combined ratio to settle in the upper 80%-90% level. Results were aided by a light catastrophe season with cat losses of just 1.9% from 4.2% last year. Thanks to price increases, we saw North American personal lines improve from 107.6% to 97.7%. As a reminder, 100% means an insurer pays out as much as it receives it premiums—running at breakeven. So, this unit swung to a profit, thanks to pricing improvement and better business mix. About 70% of AIG’s business is overseas, but the US is still a critical market.

My view of AIG has been that post financial crisis, AIG was underpricing risk as it essentially had to “buy” business, given its brand name was so badly tarnished. By underpricing premiums, its combined ratio was elevated, leading to subpar underwriting results. As memories fade, and it has raised prices, we are now seeing it deliver better underwriting results. Additionally, it is enjoying tailwinds from a favorable pricing environment, alongside most P&C insurers.

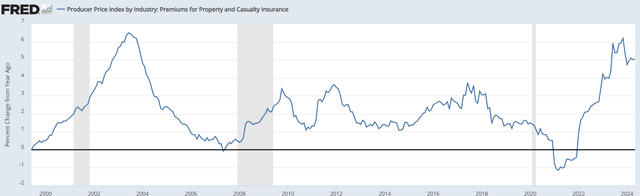

Insurance premiums can lag inflation because premiums typically last up to 12 months. This squeezed insurer profits in 2021-2022 when inflation spiked. Insurers have since increased premiums, and they are running up 5% from last year, above inflation. This has allowed companies like AIG to recover margin, helping to bring US personal lines back into profitability, for example. With premiums continuing to rise faster than inflation, I continue to expect modest sequential underwriting income growth this year.

Aside from underwriting gains, AIG also continues to be a beneficiary of the elevated interest rate environment. In Q1, it generated $762 million of net investment income, up $16 million from last year. This would have been up more based on its core portfolio, but AIG earned a 5.23% alternative investment yield from 8.77% last year, as higher rates weigh on private valuations. Private results do tend to lag public markets by one quarter, so the buoyant stock market bodes well for Q2 and Q3 returns.

AIG has a $78 billion investment portfolio. Its fixed income portfolio is high quality with just a 3.8 year duration. During the quarter, it bought bonds at 4.72%, 114bp above rollover yields. As a result, AIG now has a 3.86% portfolio yield, up 44bp from last year. Given the existing portfolio yield, I would expect positive reinvestment for the next 12 months, even assuming 1-2 Fed cuts this year and up to 4 next year.

Back in January, I forecast $4.80-$5 in 2024 earnings power, with about $2.6-2.8 billion in underwriting income and $3.1 billion in investment income. Interest rates have stayed higher for longer, allowing for a better reinvestment environment, which may push investment income to $3.2 billion. Premium growth has been a bit slower, so I expect $2.6-2.7 billion in underwriting income, leaving AIG with still about $5.8 billion in pre-tax income.

However, with a slightly faster pace of buybacks, I see share count ending the year closer to 605 million shares from 625 million, pointing to about $5.05 in run-rate EPS by year-end. With other insurers like Chubb (CB) trading around 12x earnings, I struggle to value AIG at a higher multiple, given its underwriting is not as strong for as long. That argues for a core-AIG value of about $60-$61. Adding back $14 for its CRBG holdings, AIG is worth $74-$75, right on top of where shares are today.

That leaves me believing AIG shares are fully valued. I would rather own CB at 12x or own Corebridge, given its improving earnings profile. I do not see a need to sell AIG, as it can continue to repurchase shares, and gradually grow fair value and its dividend. But I do expect returns to be mid-to-upper single digits and largely track the market. As such, I still view AIG as a hold and prefer other names in the insurance sector.

Related

Painesville American Legion post plans July 20 family fun day

American Legion Post 336 in Painesville is planning a July 20 family fun day at its 60 Chester St. post with remembrance ceremonies, food, giveaways, live music

Turkish-American business meeting highlights CANiK’s role in defense cooperation

During a meeting hosted by the Turkish American Business Council (TAIK) and the American Turkish Business Development Council (ATBR) in Washington, Turkish

Growth in core business lines produces improved profits for BNY

This is a developing story. Please check back here for updates. BNY Mellon grew its core custody and wealth management businesses while tamping down operating