Dollar Under Pressure Before Crucial US Jobs Data: Markets Wrap

(Bloomberg) — The dollar edged lower while US stock futures slipped as traders prepared for US jobs data that may determine the size of a Federal Reserve interest-rate cut this month.

Most Read from Bloomberg

Asian stocks were mixed ahead of the numbers, with the regional benchmark heading for a weekly drop. US stock futures slipped amid speculation traders are trimming some of their positions in advance of the report. Hong Kong stock trading was shut Friday morning due to a typhoon.

There’s limited event risk to be concerned about in Asia “so again the session will be defined by further pre-positioning ahead of US payrolls,” said Chris Weston, head of research at Pepperstone Group in Melbourne. “Traders will use the time in front of the screens to review, massage and manage positioning and exposures and the possible cross-market volatility that can kick up.”

Treasury yields were little changed in Asia after falling Thursday, adding downward pressure on the greenback. The Bloomberg dollar index inched lower, heading for a third day of losses. The yen and emerging Asian currencies such as the Philippine peso and the Malaysian ringgit rose.

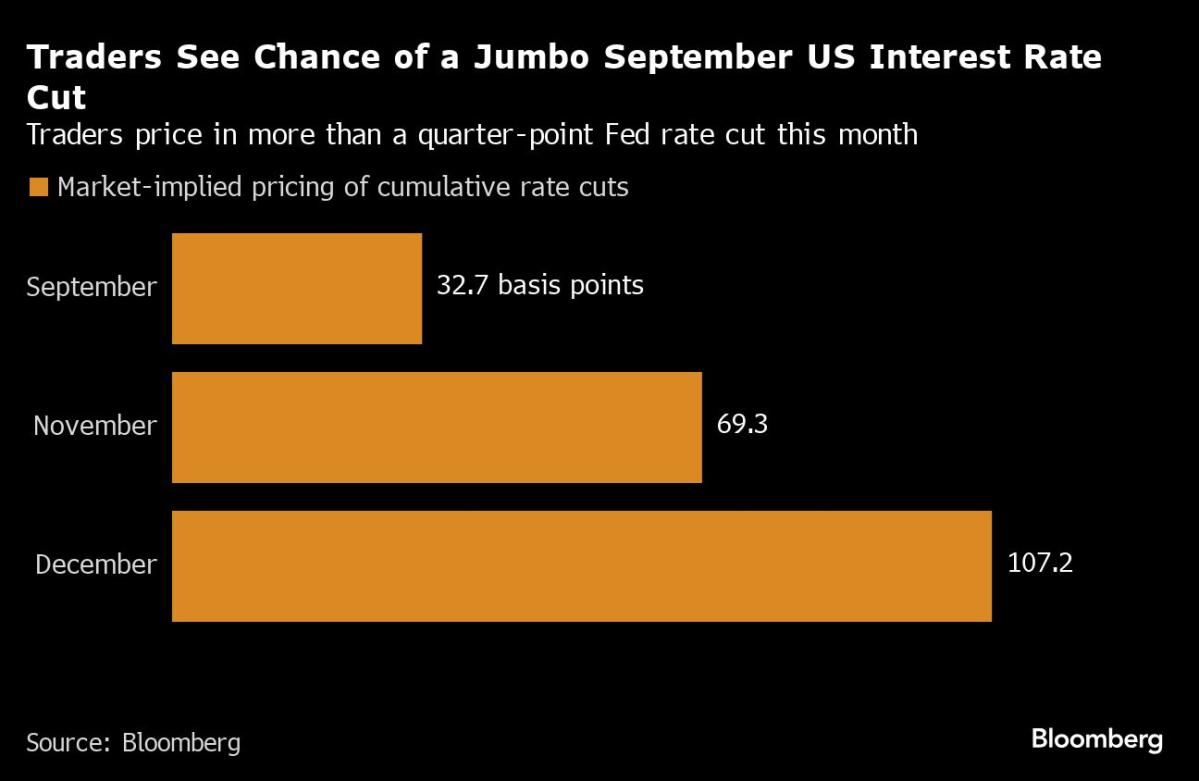

Traders are still pricing in more 100 basis points of Fed rate cuts this year, implying a potential super-sized reduction. Given Jerome Powell’s recent emphasis on the labor market, many say the payrolls report will dictate whether the central bank cuts by 25 or 50 basis points this month.

Hong Kong is expected to scrap trading of its $4.9 trillion stock market for the rest of Friday as the city extends a storm warning due to Super Typhoon Yagi, which skirted the region overnight toward southern China.

Elsewhere in Asia, China may be facing new export controls on critical technologies by the Biden administration. Washington has cracked down on China’s ability to access cutting-edge technologies needed for artificial intelligence, over fears that advanced chips and components could lend Beijing a military edge.

Markets will also be keeping a close eye on China’s bond market as some government debt the central bank bought recently is now being sold in the secondary market, according to traders — a possible sign that authorities are once again intervening to curb a debt rally.

Thailand’s parliament passed a 3.75 trillion baht ($111 billion) budget allowing newly-appointed Prime Minister Paetongtarn Shinawatra to lift state spending to accelerate the nation’s economic recovery.

The S&P 500 fell 0.3% Thursday. Nvidia Corp. climbed, with Bank of America Corp. analysts saying the recent plunge has created an “enhanced” buying opportunity. Tesla Inc. jumped on plans to launch the driver assistant in China and Europe. In late hours, Broadcom Inc. slumped on a tepid forecast.

In the run-up to the US payroll figures, economic data was mixed. Services expanded at a modest pace, companies added the fewest jobs since the start of 2021, while unemployment claims trailed estimates.

The jobs report is expected to show payrolls increased by about 165,000, based on estimates. While above the modest 114,000 gain in July, average growth over the most recent three months would ease to a little more than 150,000 — the smallest since the start of 2021. After the report, New York Fed President John Williams and Fed Governor Christopher Waller are scheduled to make comments.

“The danger in really ‘bad news’ is that even if the Fed is prepared to react aggressively, it might be too late to stave off real economic weakness,” Steve Sosnick at Interactive Brokers said. “But there is a worry that if the news is ‘too good,’ the Fed might be reticent to cut rates as fast as the market has come to expect.”

Oil edged higher Friday as OPEC+ postponed its oil supply hike by two months. The move, however, wasn’t enough to roll back steep losses in crude prices amid fears about fragile demand. Gold held onto its gains as traders digested the latest US data readings.

Key events this week:

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 10:45 a.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 0.2%

-

Japan’s Topix fell 0.3%

-

Australia’s S&P/ASX 200 rose 0.2%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite rose 0.2%

-

Euro Stoxx 50 futures fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1112

-

The Japanese yen rose 0.1% to 143.30 per dollar

-

The offshore yuan was little changed at 7.0872 per dollar

Cryptocurrencies

-

Bitcoin rose 0.7% to $56,475.8

-

Ether rose 1.1% to $2,392.91

Bonds

-

The yield on 10-year Treasuries was little changed at 3.73%

-

Japan’s 10-year yield was unchanged at 0.870%

-

Australia’s 10-year yield declined one basis point to 3.92%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Related

U.S. economy adds jobs as federal layoffs and rising unemployment…

Julia Coronado: I think it's too early to say that the U.S. is heading to a recession. Certainly, we have seen the U.S. just continue t

The job listing site highlighting H-1B positions so Americans can…

A mysterious new job listings website recently went live, solely showing roles companies want to offer to their H-1B holders seeking Green Cards in an attempt t

Tepid February Jobs Report Boosts Odds of a June Fed…

Federal Reserve Board Chairman Jerome Powell speaks during a news conference. Photo by Chip ... [+] Somodevilla/Getty Images.Getty Images The February jobs repo

French university offers jobs to American scientists afraid of government…

As the current federal government in the U.S. has been freezing or cutting funding for several research grants, a French university has stepped in with an offer