Wall Street’s Big Bet on Jumbo Fed Cuts Hangs on US Jobs Report

(Bloomberg) — The bold bet from the likes of Citigroup Inc. and JPMorgan Chase & Co. that the Federal Reserve will slash interest rates by a half-percentage-point this month faces its biggest test yet from Friday’s US jobs report.

Most Read from Bloomberg

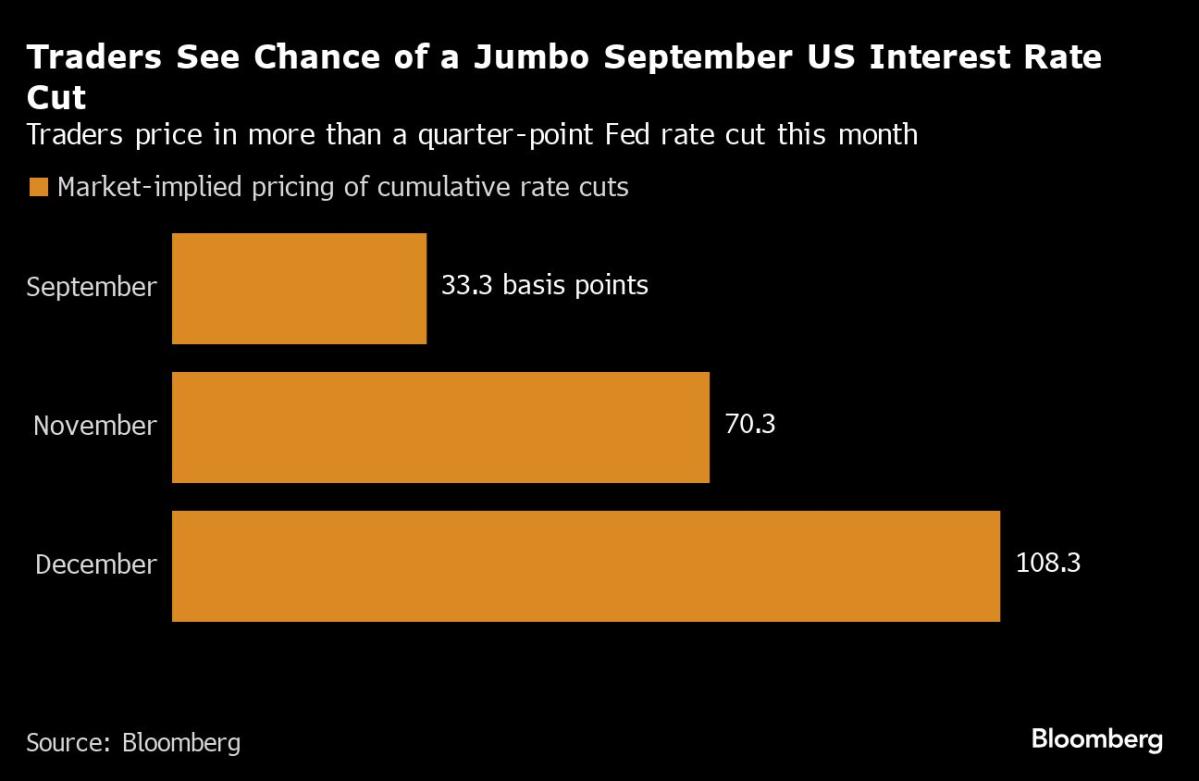

Interest-rate swap contracts show a roughly 35% chance that the Fed executes a jumbo cut when it meets Sept. 17-18, but a quarter-point reduction is still favored by traders and remains the more popular call among economists. That split has boosted the scope for big gains and losses in the Treasury market around the jobs report, which last month helped send markets into a tailspin when the employment figures missed expectations.

“There’s a big amount of uncertainty that seems likely to be resolved by the end of this week,” said Matthew Raskin, US head of rates research at Deutsche Bank AG.

If market-implied expectations shift decisively toward one outcome or the other, wagers on a 25-basis-point move will “make a little or lose a lot — and the opposite if you’re betting on 50 basis points,” he added.

Fed Chair Jerome Powell has put the labor market at the heart of the central bank’s decision on when and how quickly to ease. Market expectations for a bigger move increased Wednesday after weak data on July job openings, and early Thursday after ADP’s gauge of private-sector job growth in August rose less than expected.

The day after the jobs report, the Fed enters its customary quiet period, during which it refrains from commenting on policy before a meeting.

Typically over the past 15 years, there’s only a 3-basis-point difference between the swap-implied expectation at the start of the quiet period for what the Fed would do and what policymakers ultimately decide on, according to Deutsche Bank. With about 34 basis points of easing currently priced in, that would suggest a chunky move for swaps this week either down to at least 28 basis points or up to 47 basis points or higher — if the data clearly favor a quarter- or half-percentage-point cut.

“There’s a lot of uncertainty in the market about the employment report, the stock market and what the Fed is going to do, and the last one is very dependent on the first two,” Alex Manzara, a derivatives broker at R.J. O’Brien & Associates, said. The S&P 500 Index has fallen more than 2% on three occasions since late July.

Options on Treasury two-year note futures are priced at levels that anticipate a roughly 17-basis-point yield change in either direction on Friday, said Manzara.

Meanwhile, futures on the Secured Overnight Financing Rate — an overnight interest rate that’s influenced by the Fed’s policy rate — have a higher degree of conviction that the central bank will opt for a half-percentage-point cut, said David Robin, interest-rate strategist at TJM Institutional Services LLC.

And currency traders haven’t been this animated before a US jobs report in more than a year. Options used to gauge swings in the dollar versus its main trading partners hit the highest level for the day before the key non-farm payrolls print since March 2023. So-called risk reversals, a barometer of market positioning, show bearish sentiment prevails for the US currency, and some traders are steering clear of short-term bets altogether, given the uncertainty.

What Bloomberg Strategists Say…

“Part of the reason why Friday’s payrolls report is looming so large for markets is the way the bond market is biased toward anticipating the Fed will either kick off the coming easing cycle with a 50bp interest rate cut or deliver one soon after it starts. A look at the history of Fed rate reductions highlights the potential that bond bulls are charging too hard.”

— Garfield Reynolds, MLIV Team Leader

Citi and JPMorgan have been calling for a half-percentage-point cut in September and November, and a quarter-point cut in December since Aug. 2 when July employment data came in weaker than anticipated. At the time, JPMorgan economists even said there was a “strong case” for the Fed to act before Sept. 18 in what would be the first intermeeting rate cut since March 2020.

The market was in sync with their view, pricing in nearly 125 basis points of easing by the end of the year amid a broad selloff. But subsequently, the consensus fell in response to strong retail sales and declining jobless claims. Swaps now show about 110 basis points of easing for the year — a tally that nonetheless suggests at least one 50-basis-point cut.

Citi and JPMorgan recently tempered their views without changing forecasts. Citi said that if the US unemployment rate falls to 4.2% from 4.3% in August, then the Fed could cut rates by only 25 basis points “unless payroll growth is also soft.” JPMorgan said a 50-basis-point cut “will depend in part on the August jobs report.”

If the job results fail to lock in either a quarter- or half-point cut, there’s still the August consumer inflation data slated for Sept. 11 that could provide guidance. But if that fails to sway the market one way or another, policymakers may break their silence and hint at what they plan to do, said Raskin.

“They do not like to surprise the market at policy meetings,” he added.

–With assistance from Vassilis Karamanis and Alex Nicholson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Related

U.S. economy adds jobs as federal layoffs and rising unemployment…

Julia Coronado: I think it's too early to say that the U.S. is heading to a recession. Certainly, we have seen the U.S. just continue t

The job listing site highlighting H-1B positions so Americans can…

A mysterious new job listings website recently went live, solely showing roles companies want to offer to their H-1B holders seeking Green Cards in an attempt t

Tepid February Jobs Report Boosts Odds of a June Fed…

Federal Reserve Board Chairman Jerome Powell speaks during a news conference. Photo by Chip ... [+] Somodevilla/Getty Images.Getty Images The February jobs repo

French university offers jobs to American scientists afraid of government…

As the current federal government in the U.S. has been freezing or cutting funding for several research grants, a French university has stepped in with an offer