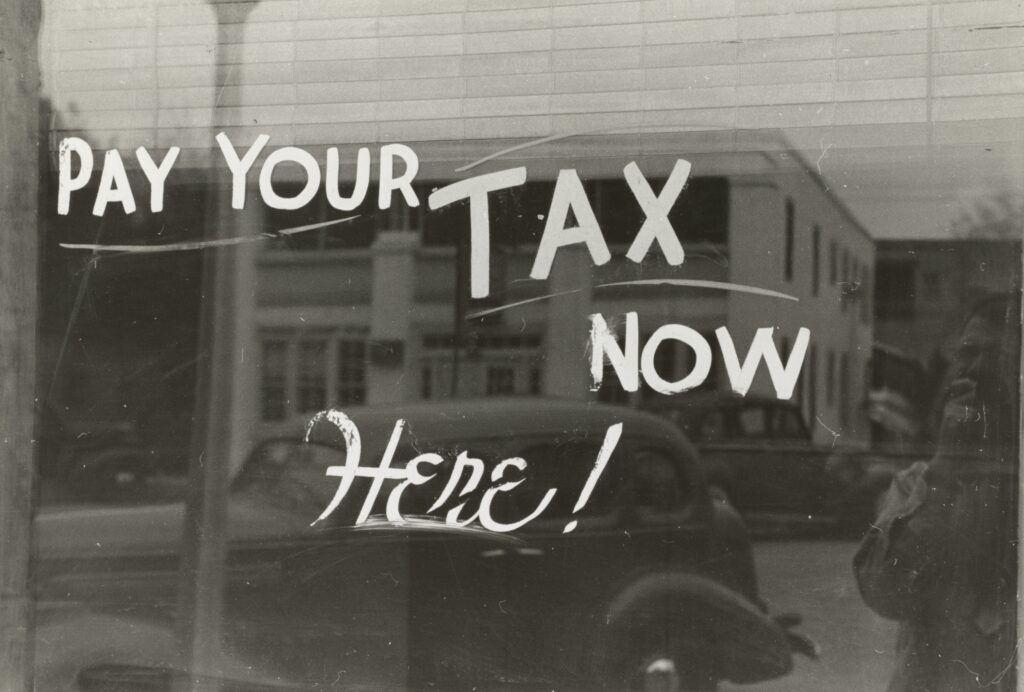

What’s The Real Cost Of Doing Business In The American Gambling Industry?

“If it moves, tax it.“ – Ronald Reagan

Estimates suggest that almost two-thirds of American adults engage in at least some form of gambling each and every year. And with plenty of options to choose from – everything from casual games of bingo to high-stakes roulette- it’s clear that gambling offers a diverse range of exciting experiences to suit just about every personal preference. And then, with the huge take-off of online gambling, the hobby has further broadened its appeal by allowing players to place bets and have fun from the comfort of their homes, during their daily commute, or on holiday.

This has inevitably caught the attention of both the state and federal governments, which, as ever, are eager to tap into the substantial revenue potential at stake. The rates and structures of gambling taxes vary significantly from state to state, meaning it’s often challenging for operators and players alike to navigate. The recent introduction of progressive tax rates in Illinois, whereby the biggest betting companies will face a 40% levy and 20% for smaller ones, serves as a stark reminder of the impact that tax policies can have on the industry’s bottom line. While these taxes generate substantial money, they will also hit many hard. It could, potentially, impact profitability and long-term viability.

However, with many restrictions in place, it isn’t always possible to capitalize on taxation revenue. The huge increase in popularity of online poker rooms has also been touted as a big factor in America’s ever-evolving gambling landscape. While regulations have restricted the operation of online poker sites within many states in the US, Americans have turned to playing poker at offshore sites, which offer a wide array of games and tournaments. This perfectly demonstrates the sustained, unwavering demand for poker among American players, even in the face of regulatory challenges. It also highlights somewhat of a large missed opportunity of legalization, whereby the government would be able to capitalize on the continued demand for gambling via tax.

Casino Taxation And Its Issues

Taxation has a direct bearing on casino operators’ profitability and strategic maneuvers. That we know. However, recent developments, such as the introduction of progressive tax rates in Illinois, have shone a light on the heavy fiscal burden taxes impose on gambling companies.

The reverberations of these tax changes have been felt throughout the sector, so much so that it’s been causing ripples in the share prices of even the biggest industry giants. Investors have been prompted to re-evaluate the long-term profitability of these companies, which reflects the heightened sensitivity of gambling stocks to fluctuations in taxation policies.

Several states that are currently being identified as potential flashpoints for future tax adjustments that could further reshape the industry. New Jersey, Pennsylvania, and Michigan hold particular significance for iGaming, while New York (which generated $4.72 billion in revenue last year alone) and Illinois are pivotal for sports betting. Given the mammoth contribution of these states to the Gross Gaming Revenue (GGR) of major operators, any regulatory shifts in these regions will have consequences extending beyond their boundary lines.

In an attempt to minimize the risks associated with state-specific regulations, some of the major betting operators have adopted a strategy of diversification, whereby they expand their operations across multiple states. This pragmatic approach serves as a buffer against any adverse regulatory changes in any single state. And the result? The answer, it’s hoped, is a more resilient and stable revenue stream.

The Necessity Of Taxation on Gambling

There’s no doubt that gambling tax has its benefits. Overall, it offers a significant revenue stream for governments, which can be used to fund essential public services like education, healthcare, and infrastructure development.

Also, the gambling sphere can act as a catalyst for economic growth. Casinos and other gambling establishments create jobs, attract tourists, and stimulate spending in surrounding businesses. This localized economic boost can revitalize communities and create opportunities for residents.

Another key advantage of gambling taxes is their potential to reduce reliance on other forms of taxation. By generating revenue through gambling, governments can lessen the burden on taxpayers who might otherwise face higher income or sales taxes. This can be viewed as a fairer approach to funding public services.

However, for gambling businesses to thrive and contribute effectively to tax revenue, clear and consistent regulations are essential. A well-defined legal framework provides stability and predictability as it lets businesses plan investments and operations with more confidence. This provides a healthy competitive environment that can encourage innovation and growth within the industry. Ultimately, a transparent and supportive regulatory system ensures that the benefits of gambling taxes can be fully realized, benefiting both the industry and society as a whole.

But, whether many traditional and online casinos can continue to weather the storm in such difficult financial times as now, remains to be seen.

Related

Sports Betting Giant Flutter Forecasts Strong U.S. Growth To Drive…

Flutter CEO Peter Jackson.Courtesy of Flutter Entertainment Flutter Entertainment, the world’s largest online gambling company, said that it’s expecting str

BetBlocker Enters US Responsible Gambling Market

The charity, originally from the UK, launched a US unit, BetBlocker US, as part of its North American entry. The organiz

Viewers react to ’embarrassing’ JD Vance comment toward Zelenskyy as…

Social media users watching clips of the heated meeting between President Donald Trump, Vice President JD Vance and President Volodymyr Zelenskyy have called a

Ukraine latest: Zelensky urges Trump to stand ‘more firmly on…

We have Zelensky's statement in full Below, we have Ukrainian president Volodymyr Zelensky’s statement in full after touching down in the UK following a fiery